India's New Data Protection Bill: Impact on BFSI Sector - CISO Perspective

In an era of where the Banking, Financial Services, and Insurance (BFSI) sector relies increasingly on data-driven operations, the soon implementation of India's Digital Personal Data Protection (DPDP) Act, along with other regulatory changes, holds significant implications with how this sector will process customer personal and financial data. The role of Chief Information Security Officers (CISOs) will be impacted by these changes on a global scale, as they begin preparing for compliance.

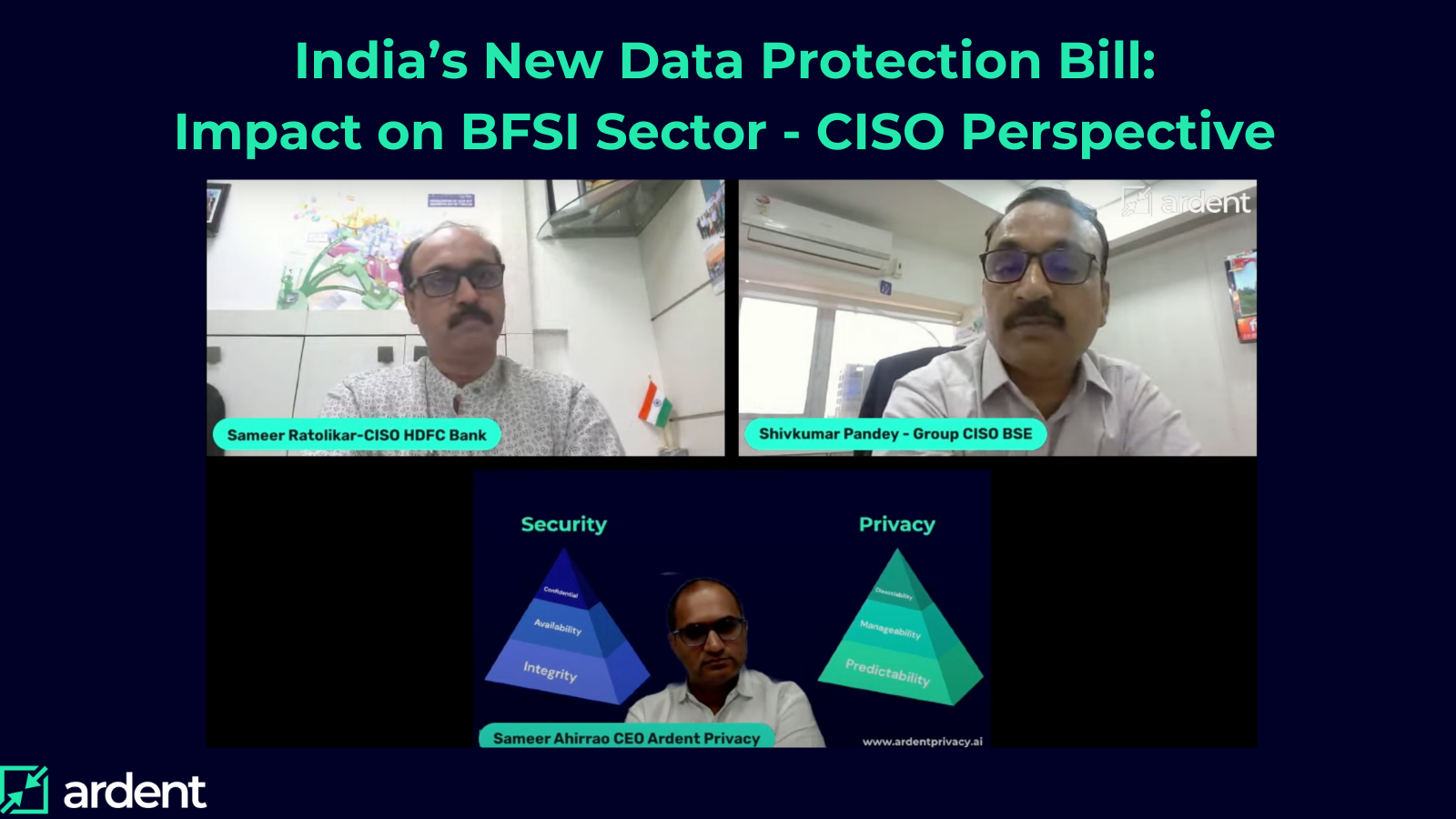

On September 1st 2023, Ardent Privacy hosted a Linkedin Live event featuring our CEO, Sameer Ahirrao, along with a panel of distinguished experts, Sameer Ratolikar, Senior Executive Vice President & CISO at HDFC Bank, & Shivkumar Pandey, Group CISO at Bombay Stock Exchange. They provided valuable insights into how the BFSI sector can navigate the complexities of the DPDP Act, from the perspective of a global CISO.

In the live event, they discussed mainly on the following points:

- An overview of the DPDPA from the perspective of a global CISO

- The impact of the DPDPA on organizations in the BFSI sector

- Consent Management in B2B or B2B2C environments

- Changing roles of CISOs & DPOs and evolving functions within organizational structures

- Adopting privacy culture in India and evangelizing core data privacy principles and privacy rights to data subjects

- The importance of a data-centric approach: specifically with Data Bill of Materials & Data Minimization

- Q/A regarding Techno-Legal aspect and Record of Processing Activity (ROPA)